INTRODUCTION

As consumers in a modern day capitalist society, we often find money to be our greatest ally. Clothes, furniture, food—none of these would be possible to obtain without money. Yet despite the benefits of having it, money, or rather the lack of it, can also be our greatest enemy.

Inflation is a term defined as the overall increase in the price of goods and services in an economy, according to the U.S. Department of Labor. And as prices rise, these increased expenses put a strain on our wallets.

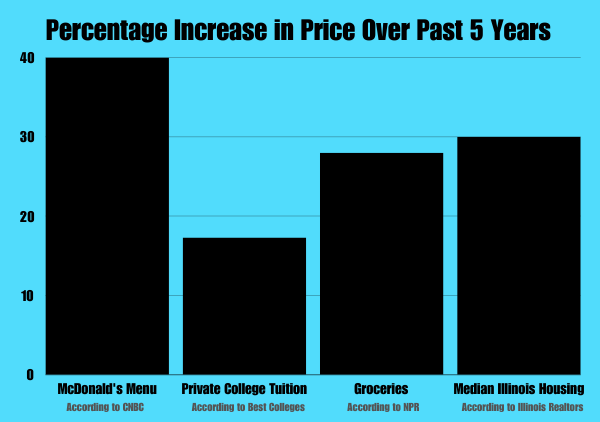

Most notably in our lifetimes, we have seen the effects of inflation from the Great Recession of 2008 or the COVID-19 pandemic that caused skyrocketing prices and unemployment in the United States. Even now, though the current annual inflation rate is now at 2.4% and no longer trending upward, according to Ellevest, an investment platform and financial literacy program, high prices remain prevalent in our daily lives. Goods and services such as gas, groceries, housing, and college tuition now boast prices up to 25 percent higher than years past, according to CNBC.

What of the future? Will prices continue to inflate and if so, how much? How will the government respond to new periods of inflation and with what policies? What future disruptions could result, and how will that affect the purchasing power of consumers and the decisions of producers?

As high prices continue to pervade markets, causing the prices of items—necessities and luxuries alike—to increase, inflation has become a more relevant topic than ever before. In this issue, Spotlight delves into the effects of inflation on daily life and what the future holds.

ENDURING INFLATION HEAD-ON

Gas, groceries, utilities. Goods and services that millions of people use on a daily basis have seen increasingly high prices due to a mixture of current events: wars, hurricanes, disruptions in the supply chain, and even lasting impacts from COVID-19. As a result, Americans are directly facing the current effects of inflation.

The impacts of inflation largely manifest due to imbalances in percent increases between wages and prices, which Christopher Bennett, social studies and economics teacher, says is an important comparison to make when determining if rising prices actually make a difference in one’s life.

“If inflation is six percent [and] your boss gives you a three percent raise, your purchasing power falls. But if inflation is one or two percent and you get the same three percent raise, now you’re making more money from year to year,” Bennett said. “The problem in the last two years is that prices have been going up faster than wages.”

Because inflation partially arises from a disruption of wage increase and price increase, Bennett says that different socioeconomic groups experience inflation in different ways. Anna Tsybyk, sophomore, adds that it is those with the least amount of income that feel the impacts of inflation on their purchasing power the most.

“A lot of students at LZHS don’t work, and their families can’t fully support their [child’s] gas money, lunch money and things like that,” Tsybyk said. “So I think it should be [more of] a concern for people who don’t earn enough money, or even people [who are] unemployed.”

Although inflation might have disproportionate effects for various groups, the prices themselves have clearly changed compared to times past, as Tsybyk has seen that the prices of some objects are no longer consistent with her childhood.

“When I was younger, my family was like, ‘you can pick out one toy’ and I would get a toy for $15 at most. My sister, who’s younger than me, [if] she gets one toy [now], it turns out to be $30 or $40. The prices are slowly getting higher and higher as we become older,” Tsybyk said.

When money is tight, the items that people most often sacrifice are those that are utilized for leisure or pleasure, such as entertainment opportunities, clothes, or junk food. Other times, people adapt by opting to make changes in their purchasing behaviors. For example, Edward Demyanov, junior, says that his family has made the switch from gas to electric vehicles to avoid high gas prices.

“I’d say my dad likes to think he [switched cars] for the environment, but if you really delve into it, it really sounds like he’s doing it just because it saves money,” Demyanov said. “I feel like most people, including my parents, have switched to mostly electric or hybrid vehicles due to the fact that the price [of gas] is outrageous.”

While many find that they have changed their spending habits, this might not always be the case when it comes to necessities, in which people have to make purchases no matter the price. Bennett contends that for those who are still driving gas vehicles, even high prices have largely failed to incentivize others to buy less gas.

“Everyone complains [about] gas prices. Nobody wants to pay higher prices, but when gas prices go up, you watch the nightly news and they’re interviewing people filling up their tank, and they’re like, ‘Oh, my God, this is ridiculous.’ Prices are so high, but is anyone actually changing their behavior? Is anyone actually driving less? Is anyone actually carpooling?” Bennett said.

Just like with gas, Bennett finds that inflation does not necessarily change his behaviors, and despite the prices, goes about his daily life as usual.

“I’m gonna stop every morning and get an egg McMuffin regardless. Do I pay attention to that? Not really. Am I going to go out to dinner with my friends and have chicken wings? Yes, I am,” Bennett said. “So they haven’t gone up enough that people [change] their behaviors; they’re just sucking it up and paying the higher price.”

Regardless of people’s response, food has become undeniably more expensive, as 54% of young Americans aged 18-34 say that “rising food costs have hit them the hardest,” according to CNBC. But this does not just include food in restaurants and grocery stores either. As LZHS recently switched to a new food provider, Quest Food Management Service, students like Demyanov have noticed the greater cost of school lunch.

“I have noticed that some of the prices at the cafeteria certainly add up. I don’t know too much about it, because I usually get the [food] that gets government aid so the price is knocked down, but the specials they do [or] if you add chips or a drink, it can really add up quick to the point where it’s almost like you’re buying at a fast food place or a restaurant, as opposed to what should be the cheap cafeteria food,” Demyanov said.

Despite the clear increases that students and staff have noticed in the prices of everyday goods and services, Darren Rothermel, business teacher, says he cannot necessarily attribute it to inflation.

“I went to [the] grocery store and bought a case of Diet Pepsi for my wife. It was $16 at Jewel Osco and I thought to myself, ‘man, that’s ridiculous,’ because I can remember buying a case of Pepsi years ago for $4 or $5[..],” Rothermel said. “In that one instance, you could think, ‘oh, it’s because of inflation.’ But it really could just be a simple case of Jewel Osco or Pepsi raising their prices because they realize that people are going to pay it.”

However, whether these higher prices are a result of inflation or business’ marketing strategies to increase profits, its effects on people vary.

“Depending on what category you’re looking at, sometimes low prices are not always great for every industry [or] every person. There are tons of corporations, for instance, that benefit from the rising price of gas or fuel oil. Then there are tons of people where the rising cost of gas is devastating to their budget,” Rothermel said. “So it just depends on what an individual or a group of people, [and what] their circumstances are. That is the tough part of business, economics, and politics. It’s all tied into everything.”

CONCERN FOR FUTURE BALLOONING

The high school years are the final years students have before they enter the “real world” as an adult. This means students gain a greater responsibility towards managing finances and other big responsibilities. Therefore, inflation poses great trouble for prospective students entering the workforce. As the cost of living continues to rise, students are faced with the question of how they will combat the effects of inflation.

No matter one’s socioeconomic status, it is difficult to deny that inflation has and may continue to have a severe impact on our world. Demyanov says that even though he resides in an “upper-middle class household,” he still recognizes the current economic situation as a serious concern for the future.

“My concern is something bad [may] happen to me, and, because of problems with the economy, it’ll affect me in a way that lasts, [like] paying off a [debt]. So that’s always a concern that’s hanging over my head,” Demyanov said. “But right now, it’s not too big of a concern, but I hear a lot of people talking about how they’re living paycheck to paycheck and stuff like that. And so I always feel like it’s kind of an existential threat.”

Tsybyk has also claimed she has seen the effects of inflation first hand and worries it will impact the near future, with college and living expenses.

“I feel it’s going to be harder to afford [things] after I go to college,” Tsybyk said. “It’s going to be harder to afford food. If I’m in college, I won’t have money to buy clothes or things like that. I wouldn’t want a car because of gas money and I would [also] shop at cheaper stores; you will not catch me at Whole Foods, you’ll catch me at [a] cheaper store that I can still rely on.”

The greater impending issue for students, however, is college tuition. Although Demyanov notes many colleges do not require students to pay the price publicly released due to financial aid packages and scholarships, the cost of some schools has deterred him from even applying.

“I’m not super concerned [with college tuition rates], just because oftentimes, you get a lot more aid even though the price tag is quite large. I certainly have seen [the price] spike up to the point where I’ve considered not going to certain colleges just because the tuition is so high. It certainly is a concern; maybe it’s not a huge concern for me, but I think I acknowledge it. I feel like it’s pretty much gotten out of control,” Demyanov said.

While inflation poses a threat to the cost of living after high school, it is also especially concerning for the future of the housing market. Tsybyk, having recently moved with her family, says that this experience in the current housing market has raised concerns for its future.

“We bought my house after COVID, and we paid a lot for it, which, I think you could have bought the same house, maybe for like, $200,000 less in 10 years before COVID happened,” Tsybyk said. “So I am scared that even smaller houses or apartments are gonna cost like $200,000 or $300,000; I could probably buy a house for that money. So I am not too excited about that.”

Altogether, however, it is important to note that the increased prices of today will not have as much of an impact on society in the future. Bennett believes that the increase in prices will be counteracted with a corresponding increase in wage, and eventually, the cost of living will be the same relative to how it was before.

“Prices are going down now, so therefore, because they’ll realize prices [will] come down, people will think that [they] don’t necessarily need to have the bigger wage increases to make up for that,” Bennett said. “Wage increases will also probably have to catch up so that we can get back to a place where groceries were the same relative cost that we work for. So I used to go shopping for my groceries and they were $200 and now they’re $275 like I said, before my wages need to go up so that it’s the same relative cost.”

With the question of the future at hand, it is difficult to know whether or not prices will continue on the upward trend. However, that might just be a reality people need to accept.

“[Knowing whether or not inflation will continue to rise] is predicting the future,” Rothermel said, “and that’s impossible to do.”